Taxes You Might Not See Coming

For most people, retirement feels like the reward for years of hard work. No more early mornings. No more deadlines. You’ve done your part, saved diligently, and now it’s time to enjoy the fruits of your labor.

But when tax season rolls around, many retirees are caught off guard.

They’re not working anymore—so why is their tax bill still so high?

And more importantly… is this what the next 20 or 30 years of retirement will look like?

The truth is, retirement doesn’t automatically come with lower taxes. In many cases, the way your income shows up in retirement can lead to more taxes than you expected—unless you plan ahead.

Retirement Income Isn’t Always What It Seems

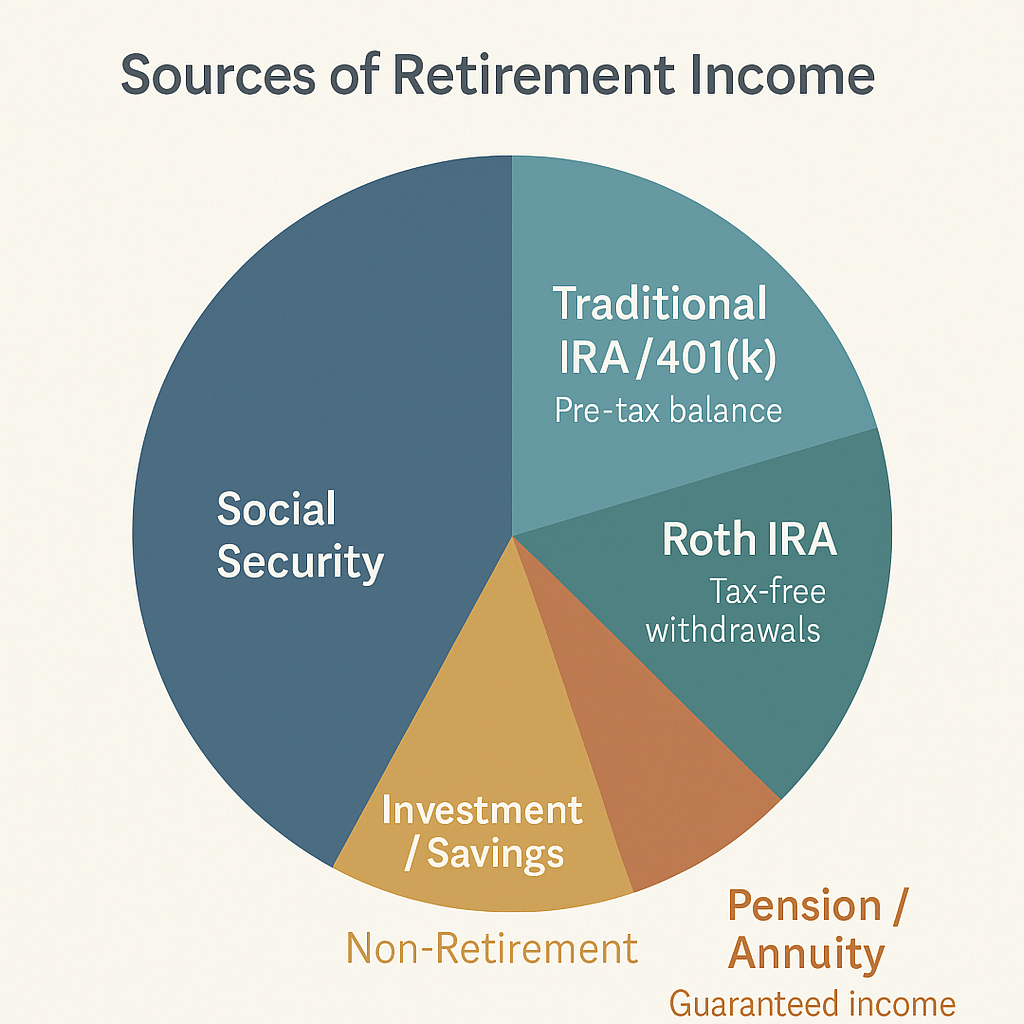

Most people enter retirement with income coming from several different places—Social Security, IRAs or 401(k)s, pensions, maybe some savings or investment accounts. And each of those sources gets taxed differently.

Some of it, like a Roth IRA, may be tax-free. But others, like your traditional IRA or pension, are taxed just like regular income. And once you hit age 73, the IRS requires you to start taking withdrawals from certain accounts, whether you need the money or not.

These “Required Minimum Distributions” (RMDs) can end up pushing you into a higher tax bracket, even years after you stopped working.

And Social Security? That’s not always tax-free either. Depending on your total income, up to 85% of your benefit could be taxable.

It’s Not Just About This Year—It’s About the Long Game

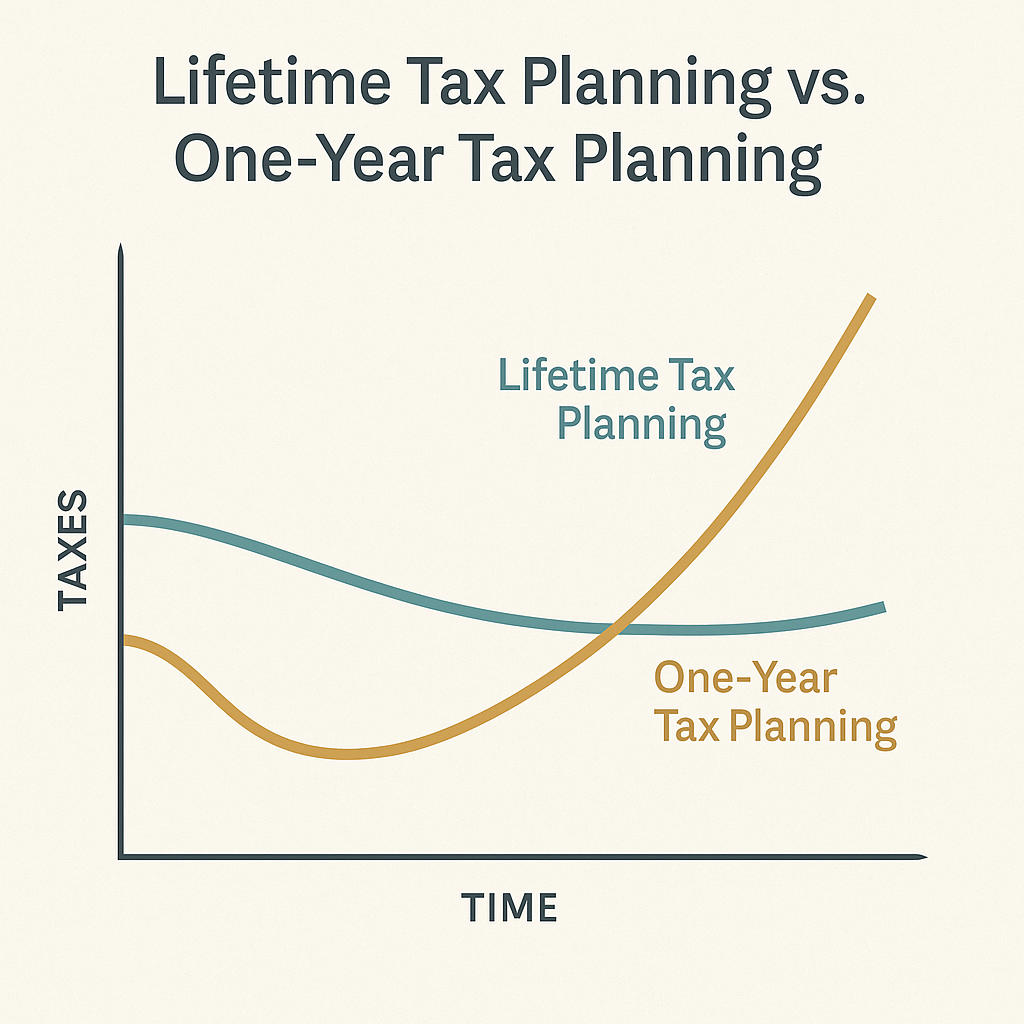

One of the biggest misconceptions we see is the idea that good tax planning is about minimizing taxes this year.

And while that’s important, the real opportunity is in managing taxes over the entire course of your retirement. Because without a long-term plan, even small decisions—like which account you pull from first—can have big ripple effects years down the road.

A strategy that saves you a few hundred dollars this year might end up costing you thousands later on if it leads to higher RMDs, increased Medicare premiums, or unnecessary taxes on your Social Security.

That’s why we focus on the full picture—helping our clients create retirement income plans that work year by year and decade by decade.

A Simple Framework That Makes a Big Difference

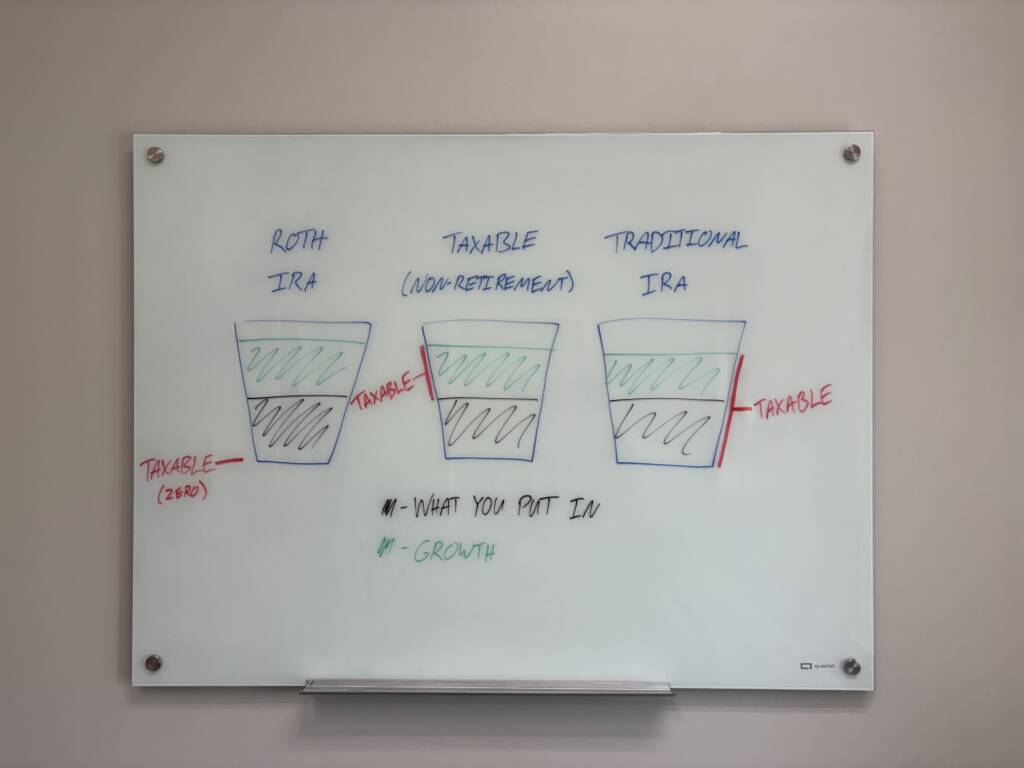

When we sit down with families, one of the first things we do is help them understand how their retirement savings are structured. We often explain it using three buckets:

- Tax-deferred (like Traditional IRAs and 401(k)s): You haven’t paid tax on this money yet—you’ll pay it when you take it out.

- Tax-free (like Roth IRAs or HSAs): You’ve already paid tax, so withdrawals are generally tax-free.

- Taxable / Non-Retirement (like investment or savings accounts): These accounts are taxed along the way through dividends, interest, and capital gains.

Where your retirement income comes from—and in what order—can dramatically affect your tax bill. The more flexibility you have across these buckets, the more control you have over how much you pay in taxes over time.

What You Can Do Now

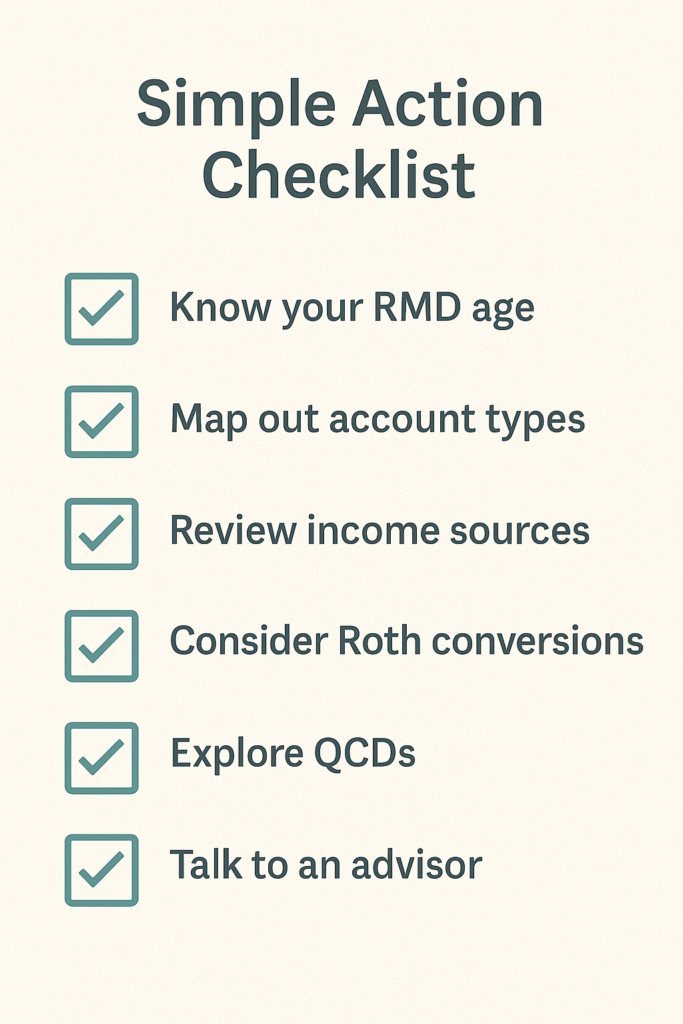

Even small steps can make a big difference over time. Here are a few ways to start thinking about your tax plan differently:

And most importantly—don’t feel like you have to figure it all out alone.

Final Thought

You’ve done the hard part: you’ve saved, you’ve sacrificed, and you’ve made it to retirement. Now it’s time to make sure you get to enjoy it—without unnecessary tax surprises along the way.

Because retirement isn’t just about what you have—it’s about how you use it.

If you’re not sure whether your current income plan is working as hard for you as it could, let’s talk. A short conversation can go a long way toward giving you confidence not just for this year… but for every year ahead.