Lately, we’ve had more than a few people mention how good their accounts are looking now after the recent drop. And I get it—checking your retirement balance right now can feel like stepping on the scale after a week of salads. Feels nice, doesn’t it?

But here’s the thing: just because the market’s up doesn’t mean it’s time to put your plan on autopilot.

If anything, this is the best time to make sure your plan is actually doing what you need it to do.

When the Market’s Calm, It’s Easier to Think Straight

I’ve got three mischievous little boys at home: 4, 3, and 1 year old. One thing I know to be true is that there can be a false sense of calm in the house.

If it’s quiet, it probably means that either they are all asleep… or someone was getting ready to launch something (or someone) off the couch. Point is, silence doesn’t always mean peace.

Same goes for the market.

When things are calm and green, it’s tempting to think you’re in the clear. But retirement planning isn’t about how things look right now—it’s about whether your plan can hold up when life eventually throws a wrench in the gears.

A Few Questions Worth Asking (While Things Are Good)

Unlike what a lot of financial news outlets give you, this isn’t a call to panic. If anything, it’s a call to be proactive while you’re not panicking. Here are a few things we would encourage you to think through right now:

- Are your investments aligned with your income needs—or just riding the wave?

- Do you know what your withdrawal plan actually looks like?

- Have you considered how taxes could impact your retirement income long-term?

- What would a market downturn mean specifically for your plan—not in theory, but in dollars?

You don’t need to have all the answers. That’s the point of a good plan—it’s meant to walk you through these questions before they become urgent.

Why Now Is the Time to Revisit Your Plan

We don’t have a crystal ball (and neither does anyone else for that matter) to tell you what the market is going to do. What we do have is experience walking people through uncertain markets—and helping them stay steady because they already had a plan in place.

When you’ve got margin, you can make changes without pressure. You can be thoughtful instead of reactive.

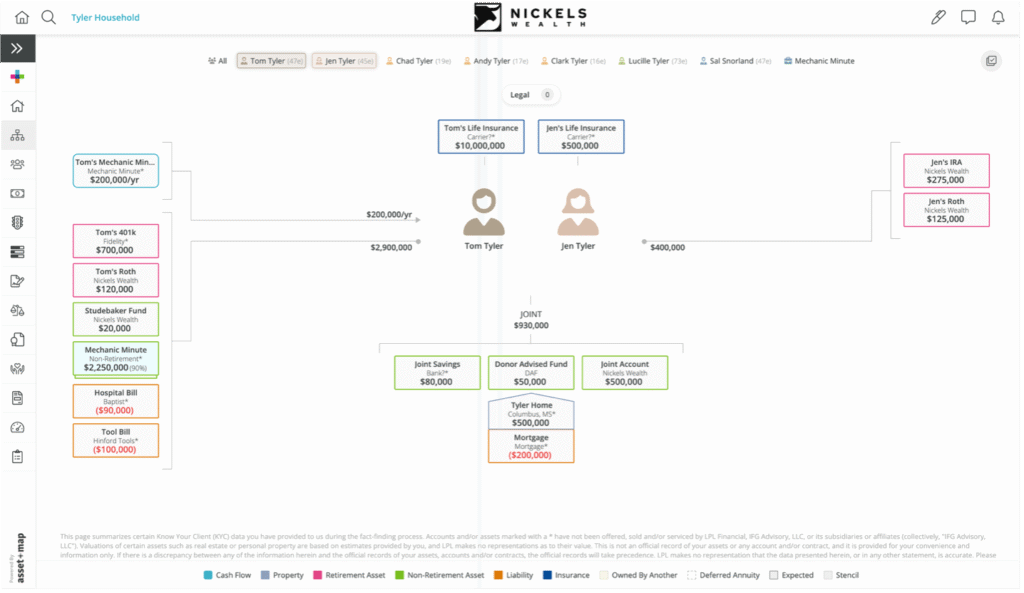

That’s what we help people do every day at Nickels Wealth. Whether it’s walking through a whiteboard session in our office or building a visual overview of their financial life, our job is to help people see how all the pieces fit—and how to make smart moves when there’s room to breathe.

If You’re Wondering What to Do Next, Here’s a Simple First Step

If you’re nearing retirement (or already in it) and thinking, “I hope this plan still works if the market shifts again,”—we should talk.

Click the link below to fill out our quick Asset-Map Discovery form. It’ll help us build a visual overview of your financial life, and we’ll walk through it together—no pressure, just a chance to see where you stand and what (if anything) needs to be adjusted.